About Us

Our Vision

IV-1 Secondary Exits was founded on the principle that the most transformative technological innovations often emerge from seed-stage companies. We believe in backing visionary founders who are solving real-world problems through technology.

Our name reflects our unique approach: we focus on secondary market opportunities that provide liquidity while maintaining long-term growth potential for our portfolio companies and investors.

Narrative of IV1 – Secondary Exits

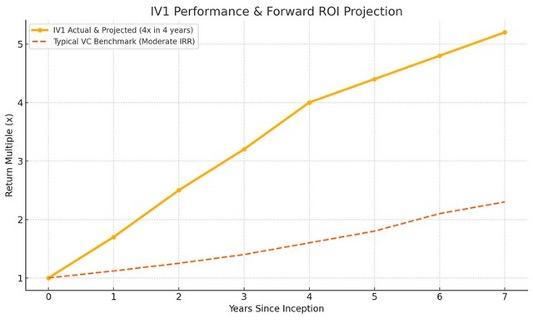

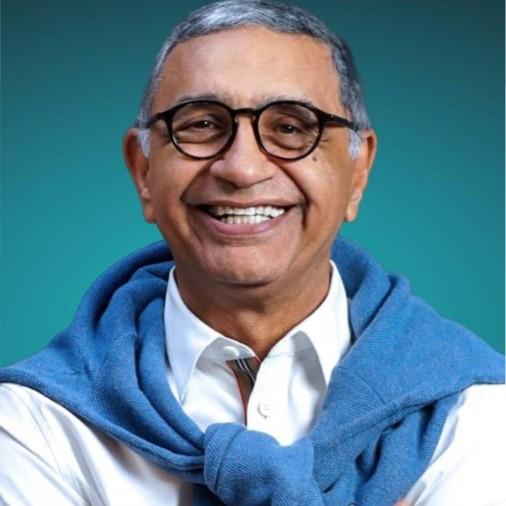

IV1-Secondary Exits was born from the personal transformation of Tarek Roushdy, who shifted from a successful corporate journey in Oil & Gas to a hands-on investment career. After achieving two major exits in 2017 and 2020, Tarek leveraged his operational expertise to launch an entrepreneurial investment path that led to funding 45 startups.

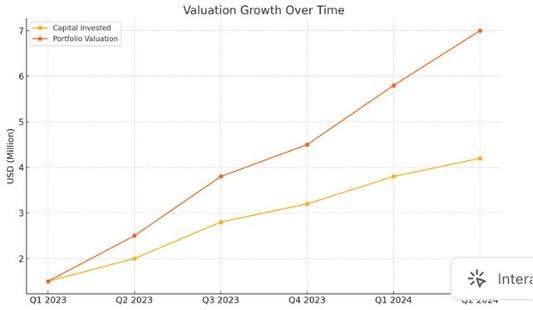

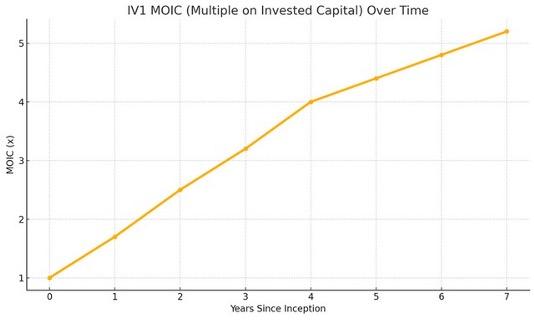

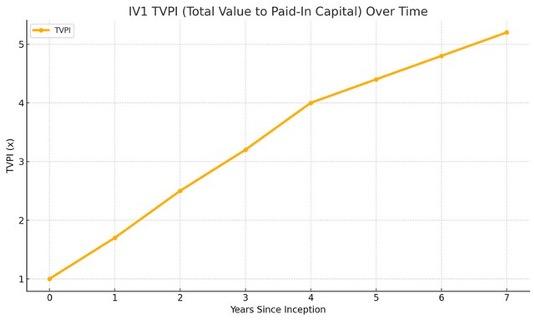

Out of this portfolio, Tarek strategically selected 10 high-performing ventures, each exhibiting "Camel-to-Unicorn" potential—resilient, scalable, and technology-driven companies with long-term value. This careful curation formed the foundation of IV1, an investment vehicle built to offer investors access to vetted startups with proven track records and real growth traction.

Guided by the Boutique Investment Concept (BIC), IV1 is not just a fund—it's a result of deep engagement, real-world startup validation, and value creation. It offers a pathway for investors to join a portfolio backed by operational insight, past investment success, and strategic vision.